Freight Insurance

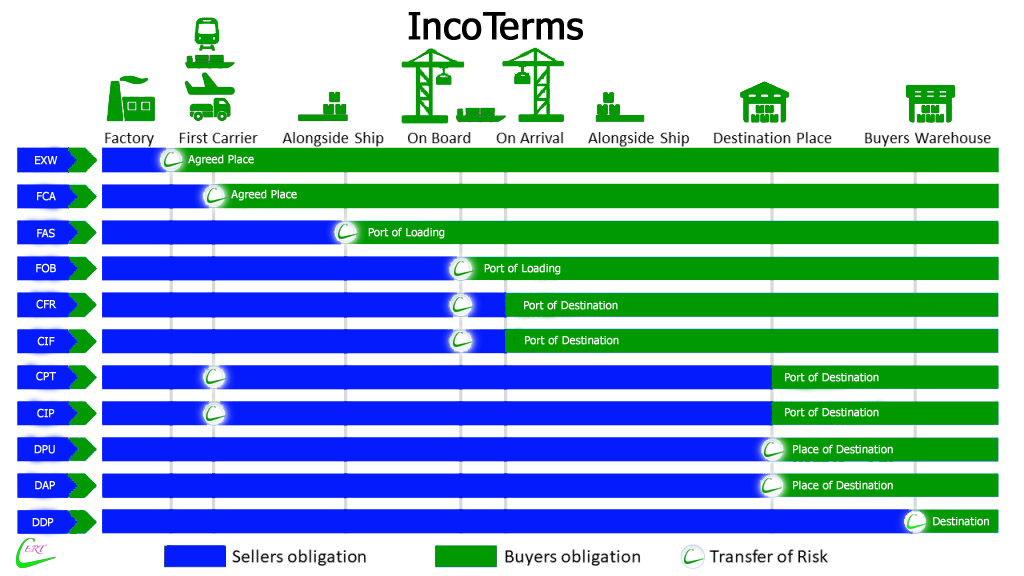

The Incoterms rules and freight insurance

Updated Sept 12 2019.

There is now an important difference between Incoterms 2010 and Incoterms 2020

Only two Incoterms rules (CIF, CIP) refer to freight insurance, which is to be arranged and paid for by the seller.

For the other rules, each party makes a commercial decision as to whether to insure for the part of the journey where they are “on risk”

Incoterms 2010

The level of cover mandated by the CIP and CIF rules is minimal, and may not satisfy the buyer’s requirements. It is Clauses “C” of Institute Cargo Clauses – excludes many risks which many buyers want covered.

Incoterms 2020

The level of cover mandated by the CIF rule is minimal – Institute Cargo Clauses (C). However for the CIP rule, there is a higher level of cover – Institute Cargo Clauses (A)

The rationale is that in general, manufactured goods will require a higher level of insurance cover than commodities

In all cases, the parties may choose to specify a different level of insurance cover within their commercial agreement

All freight insurance usually excludes consequential loss, e.g. the knock-on effects of buyer missing a contract deadline or a sales season. This risk can sometimes be included by agreement with the insurer.

So the risks to be covered should be discussed and then incorporated into the commercial agreement.

Other considerations for CIP and CIF

Once the goods have been taken in charge by the carrier (or loaded on board the ship), the buyer is “on risk”, and so must deal with the insurance company in order to make a claim. This has implications for the insurance document that the seller provides – it may need to be appropriately endorsed.

Some sellers have global freight insurance policies covering all their consignments. This often creates problems for the use of e.g. CIP . (For a single consignment, how can the insurance be costed, and how can arrangements be made allowing a buyer to make a claim?)

Some sellers find the requirement for the buyer to claim under the insurance policy unsatisfactory from a customer service perspective. In such cases, the seller may agree to take care of claims. A letter of subrogation can be supplied (seller takes over right to claim under the policy)

Even the highest of the Institute Cargo Clauses – Clauses A – excludes risks that the buyer may think are important – for example War and Strikes (for which a standard Institute clause exists)

For more details regarding the updated 2020 terms, please speak with your nominated shipping company or refer to the International Chamber of Commerce.

There are two key changes in Incoterms ® 2020 compared to the last edition:

- DAT (Delivered at Terminal) is renamed Delivered at Place Unloaded (DPU)

- FCA (Free Carrier) now allows for Bills of Lading to be issued after loading

Other changes include:

- CIF (Cost, Insurance and Freight) and CIP (Carriage and Insurance Paid To) set out new standard insurance arrangements, but the level of insurance continues to be negotiable between buyer and seller.

- Where listed, cost allocation between buyer and seller is stated more precisely – one article lists all costs the seller and the buyer are responsible for.

- FCA (Free Carrier), DAP (Delivered at Place), DPU (Delivered at Place Unloaded) and DDP (Delivered Duty Paid) now take account of buyer and seller arranging their own transport rather than using a third party.

- Security-related obligations are now more prominent.

- “Explanatory Notes for Users” for each Incoterm® have replaced the 2010 edition’s Guidance Notes, and are designed to be easier for users.

- CIP now requires as default insurance coverage ICC A or equivalent. It was ICC C under Incoterms® Required insurance coverage under CIF remains.