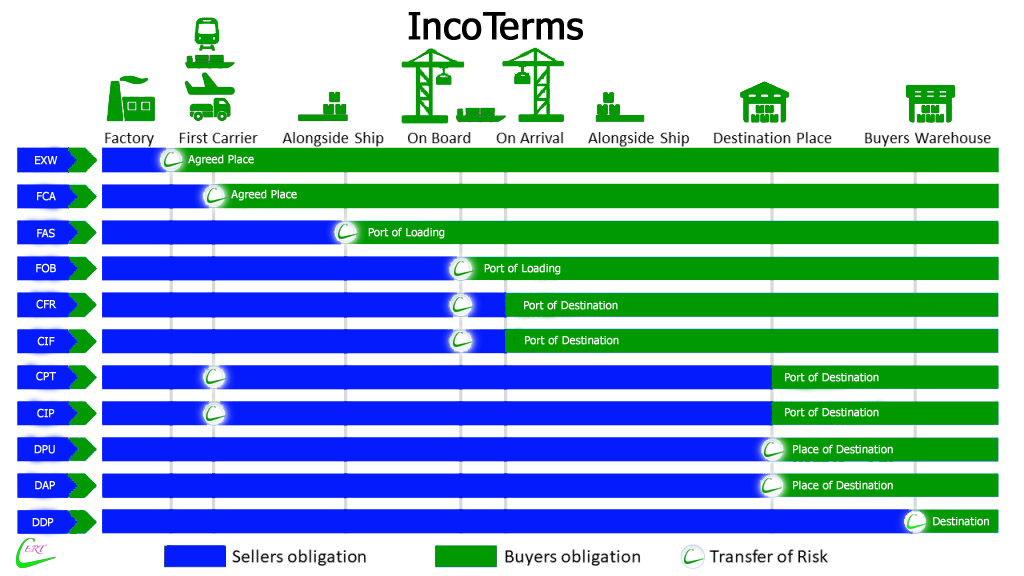

Cost Insurance and Freight (CIF)

“Cost, Insurance and Freight” means that the seller delivers the goods on board the vessel or procures the goods already so delivered. The risk of loss of or damage to the goods passes when the goods are on board the vessel. The seller must contract for and pay the costs and freight necessary to bring the goods to the named port of destination. The seller also contracts for insurance cover against the buyer’s risk of loss of or damage to the goods during the carriage. The buyer should note that under CIF the seller is required to obtain insurance only on minimum cover. Should the buyer wish to have more insurance protection, it will need either to agree as much expressly with the seller or to make its own extra insurance arrangements.

Use of this rule is restricted to goods transported by sea or inland waterway.

In practice it should be used for situations where the seller has direct access to the vessel for loading, e.g. bulk cargos or non-containerised goods.

For containerised goods, consider ‘Carriage and Insurance Paid CIP’ instead.

Seller arranges and pays for transport to named port. Seller delivers goods, cleared for export, loaded on board the vessel.

However, risk transfers from seller to buyer once the goods have been loaded on board, i.e. before the main carriage takes place.

Seller also arranges and pays for insurance for the goods for carriage to the named port.

However as with “Carriage and Insurance Paid To”, the rule only requires a minimum level of cover, which may be commercially unrealistic. Therefore, the level of cover may need to be addressed elsewhere in the commercial agreement.

Cost Insurance & Freight (CIF):

Further information

This rule and CIP (Carriage & Insurance Paid to) are the only two rules that place an obligation on the seller to arrange insurance for the consignment.

Note that this insurance covers the buyer’s risk, because risk will pass from the seller to the buyer before the main carriage.

As with the other “C” rules, a good choice for transactions involving letters of credit.

Click here for an explanation.

For more details regarding the updated 2020 terms, please speak with your nominated shipping company or refer to the International Chamber of Commerce.

There are two key changes in Incoterms ® 2020 compared to the last edition:

- DAT (Delivered at Terminal) is renamed Delivered at Place Unloaded (DPU)

- FCA (Free Carrier) now allows for Bills of Lading to be issued after loading

Other changes include:

- CIF (Cost, Insurance and Freight) and CIP (Carriage and Insurance Paid To) set out new standard insurance arrangements, but the level of insurance continues to be negotiable between buyer and seller.

- Where listed, cost allocation between buyer and seller is stated more precisely – one article lists all costs the seller and the buyer are responsible for.

- FCA (Free Carrier), DAP (Delivered at Place), DPU (Delivered at Place Unloaded) and DDP (Delivered Duty Paid) now take account of buyer and seller arranging their own transport rather than using a third party.

- Security-related obligations are now more prominent.

- “Explanatory Notes for Users” for each Incoterm® have replaced the 2010 edition’s Guidance Notes, and are designed to be easier for users.

- CIP now requires as default insurance coverage ICC A or equivalent. It was ICC C under Incoterms® Required insurance coverage under CIF remains.