Freight Forwarder’s Receipt

These go by various names, but a widely used version is the FIATA Certificate of Receipt (FCR), issued under the aegis of FIATA and its member associations in different countries (BIFA, CIFFA, TIA etc.)

The FIATA FCR has a standard set of terms and conditions, which will be referred to here. However other freight forwarders receipts may differ in important respects.

A major use of the FCR is to support trade finance and the use of letters of credit.

However the FCR is not a transport document as defined by UCP 600 (ICC code of practice for letters of credit).

Unlike a bill of lading, the FCR is not a document of title to the goods under any legal system – a major defect in the event of disputes

So it is not needed in order to claim the goods from a carrier.

The FIATA FCR

- is issued in one original by a freight forwarder to the consignor/seller.

- confirms receipt of the goods in apparent good condition.

- constitutes an irrevocable commitment by the freight forwarder to either transport the goods in a specified manner OR to act on instructions given by the consignee/buyer.

The freight forwarder can only vary the instructions in the FCR if they are able to do so (e.g. the goods have not already been dispatched) and if the original FCR has been surrendered by the holder.

An important use is for letter of credit transactions where the buyer is responsible for main transport – e.g. FCA. The letter of credit will call for this instead of a transport document such as bill of lading.

The FCR and similar documents have an indifferent reputation with buyers due to a high incidence of fraud – indeed FIATA have taken the extreme step of banning their documents for use in steel shipments!

Other risks for the buyer:

- Issue of the FCR is not a guarantee of successful export clearance of the goods – problems may arise with licences etc.

- If the consignor is an intermediary, there may be other parties unknown to the buyer who have a claim on the goods.

For more details regarding the updated 2020 terms, please speak with your nominated shipping company or refer to the International Chamber of Commerce.

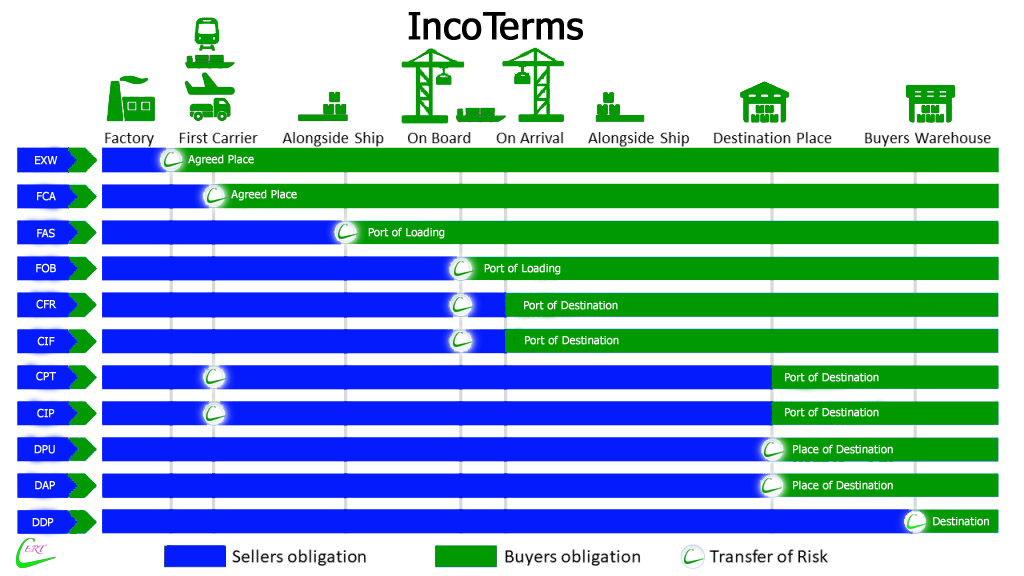

There are two key changes in Incoterms ® 2020 compared to the last edition:

- DAT (Delivered at Terminal) is renamed Delivered at Place Unloaded (DPU)

- FCA (Free Carrier) now allows for Bills of Lading to be issued after loading

Other changes include:

- CIF (Cost, Insurance and Freight) and CIP (Carriage and Insurance Paid To) set out new standard insurance arrangements, but the level of insurance continues to be negotiable between buyer and seller.

- Where listed, cost allocation between buyer and seller is stated more precisely – one article lists all costs the seller and the buyer are responsible for.

- FCA (Free Carrier), DAP (Delivered at Place), DPU (Delivered at Place Unloaded) and DDP (Delivered Duty Paid) now take account of buyer and seller arranging their own transport rather than using a third party.

- Security-related obligations are now more prominent.

- “Explanatory Notes for Users” for each Incoterm® have replaced the 2010 edition’s Guidance Notes, and are designed to be easier for users.

- CIP now requires as default insurance coverage ICC A or equivalent. It was ICC C under Incoterms® Required insurance coverage under CIF remains.