Ex Works (EXW)

“Ex Works” means that the seller delivers when it places the goods at the disposal of the buyer at the seller’s premises or at another named place (i.e., works, factory, warehouse, etc.). The seller does not need to load the goods on any collecting vehicle, nor does it need to clear the goods for export, where such clearance is applicable.

Can be used for any transport mode, or where there is more than one transport mode.

This rule places minimum responsibility on the seller, who merely has to make the goods available, suitably packaged, at the specified place, usually the seller’s factory or depot.

The buyer is responsible for loading the goods onto a vehicle (even though the seller may be better placed to do this); for all export procedures; for onward transport and for all costs arising after collection of the goods.

In many cross-border transactions, this rule can present practical difficulties.

Specifically, the exporter may still need to be involved in export reporting and clearance processes, and cannot realistically leave these to the buyer. Consider Free Carrier (seller’s premises) instead.

Other things to watch for. Although the seller is not obliged to load the goods, if the seller does so, this is at the buyer’s risk!

Ex Works (EXW): Further information

In spite of its apparent simplicity, this rule presents many pitfalls for both parties when used for cross-border transactions.

Ex Works obliges the buyer to undertake export procedures (obtaining of licences, security clearances and so on.) The buyer may be poorly placed to do this. In any event the seller is only obliged to “provide assistance”, at the buyer’s risk and expense.

From the seller’s perspective, there is the problem of obtaining evidence that the goods are to be exported – where VAT or sales tax is charged on domestic sales, the tax authorities may require this.

The obvious alternative for cross-border transactions is Free Carrier (FCA) – seller’s premises.

For more details regarding the updated 2020 terms, please speak with your nominated shipping company or refer to the International Chamber of Commerce.

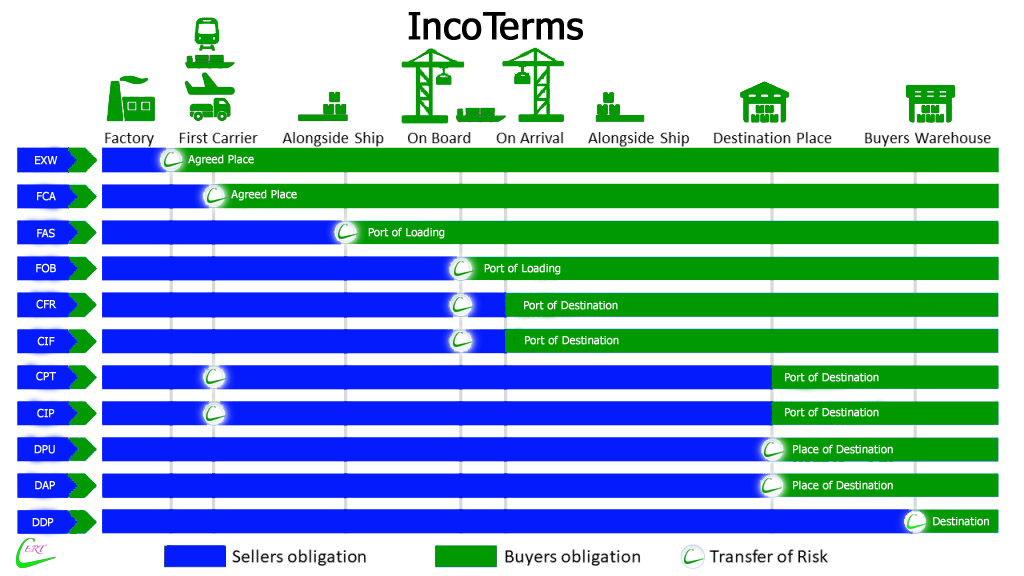

There are two key changes in Incoterms ® 2020 compared to the last edition:

- DAT (Delivered at Terminal) is renamed Delivered at Place Unloaded (DPU)

- FCA (Free Carrier) now allows for Bills of Lading to be issued after loading

Other changes include:

- CIF (Cost, Insurance and Freight) and CIP (Carriage and Insurance Paid To) set out new standard insurance arrangements, but the level of insurance continues to be negotiable between buyer and seller.

- Where listed, cost allocation between buyer and seller is stated more precisely – one article lists all costs the seller and the buyer are responsible for.

- FCA (Free Carrier), DAP (Delivered at Place), DPU (Delivered at Place Unloaded) and DDP (Delivered Duty Paid) now take account of buyer and seller arranging their own transport rather than using a third party.

- Security-related obligations are now more prominent.

- “Explanatory Notes for Users” for each Incoterm® have replaced the 2010 edition’s Guidance Notes, and are designed to be easier for users.

- CIP now requires as default insurance coverage ICC A or equivalent. It was ICC C under Incoterms® Required insurance coverage under CIF remains.